Recommended citation format: Schnitkey, G., N. Paulson, C. Zulauf and K. Swanson. "Revenue Protection: The Most Used Crop Insurance Product." farmdoc daily ( 10 ): 198, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 17, 2020. Permalink

There has been a great deal of innovation in the crop insurance industry since the early 1990s. New products have been introduced, subsidy rates have been increased, and farmers have increased crop insurance use. We summarize trends in crop insurance use for corn, soybeans, and wheat in Illinois. We focus on the multi-peril products that are Federally subsidized and administered through the Risk Management Agency (RMA). In Illinois, over 85% of the corn and soybean acres are insured in recent years. The most popular product is Revenue Protection (RP), a revenue product with a guarantee increase.

In 2011, RMA introduced the COMBO product, which consolidated predecessor plans for providing crop insurance based on farm yields. The COMBO product provides three plans differing in the type of insurance provided:

In addition to the COMBO product, RMA also has products that make payments based on county-level yields. For these insurance products, yields on a farm do not matter. RMA administers area plans through the Area Risk Protection Insurance (ARPI) policy. Three plans of insurance mirror the COMBO plans:

In addition, to the COMBO and ARPI policies, Margin Protection (MP) was introduced in 2018. MP is a county-level product that provides margin protection with or without the harvest price exclusion. MP can be combined with RP and RP-HPE. More information on MP is available in farmdoc Daily articles published on September 9, 2017 and September 12, 2017.

Also available is the Supplemental Coverage Option (SCO). SCO is available as an add-on to COMBO plans (i.e., RP, RP-HPE, and YP). SCO provides county coverage from an 86% coverage level down to the COMBO plan’s individual coverage (see farmdoc daily, December 17,2014, April 24, 2014, February 12, 2019 for more information on SCO).

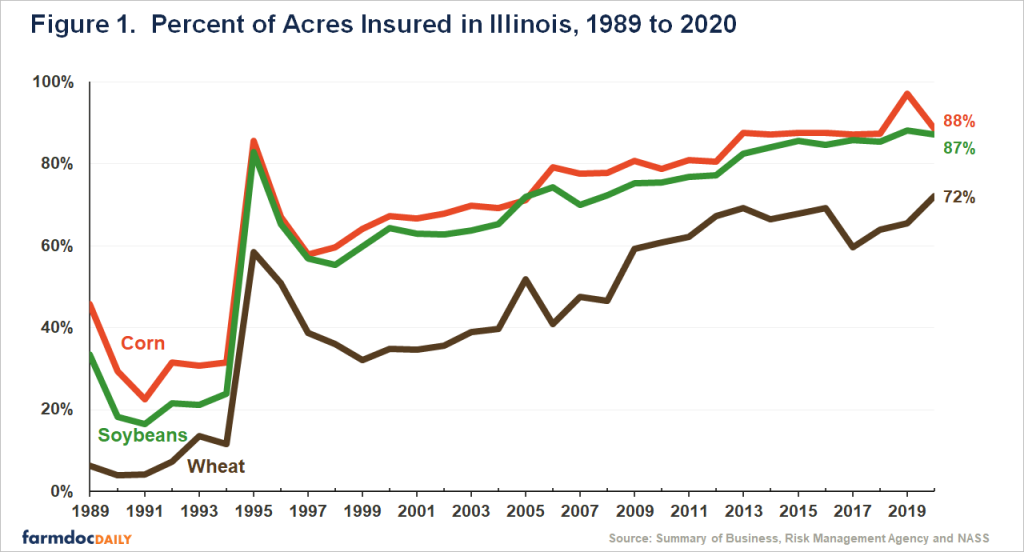

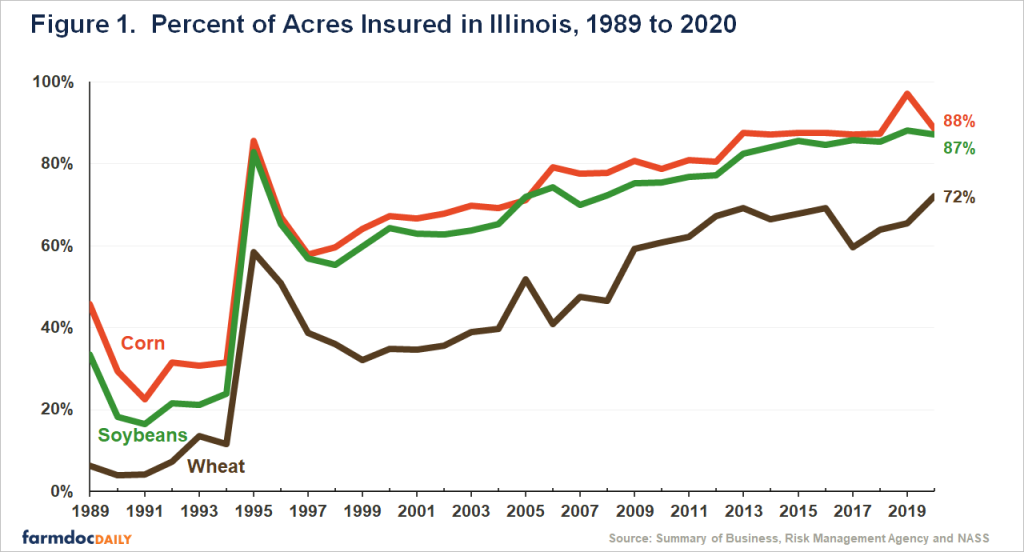

Figure 1 shows the percent of acres insured over time for corn, soybeans, and wheat in Illinois. Values in this figure are RMA reported insured acres divided by planted acres reported by the National Agricultural Statistical Service (NASS).

From 1989 to 1993, acres insured in Illinois were at relatively low levels: slightly over 30% of acres for corn, slightly over 20% for soybeans, and slightly over 8% for wheat. Percentages reached highs in 1995 as crop insurance purchases were required to receive deficiency program payments that were part of the Commodity title program. The crop insurance purchase requirement was repealed in 1996, and crop insurance participation fell, reaching lows of 58% for corn in 1998, 55% for soybeans in 1998, and 32% for wheat in 1999.

Besides participation requirements, crop insurance use was influenced by changes in premium subsidy rates in the early years. Premium subsidy rates were increased in 1994 and again in 2000. Legislated levels set in 2000 have been in place since, except for an increase in subsidy rates associated with enterprise units that occurred in the 2008 Farm Bill.

Crop insurance use has steadily increased since 2000 and has maintained stable and high levels from 2013 to 2020 averaging 89% for corn, 85% for soybeans, and 67% for wheat.

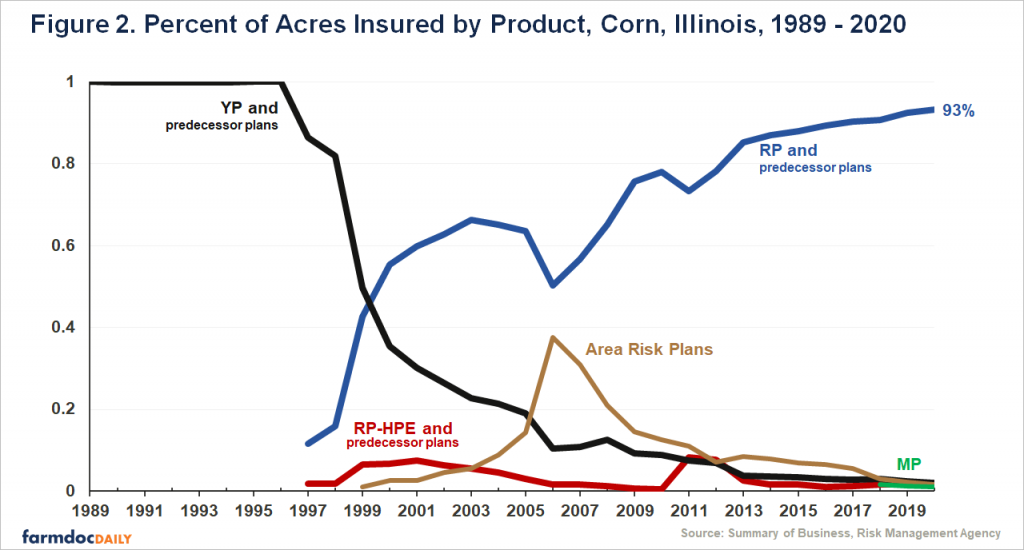

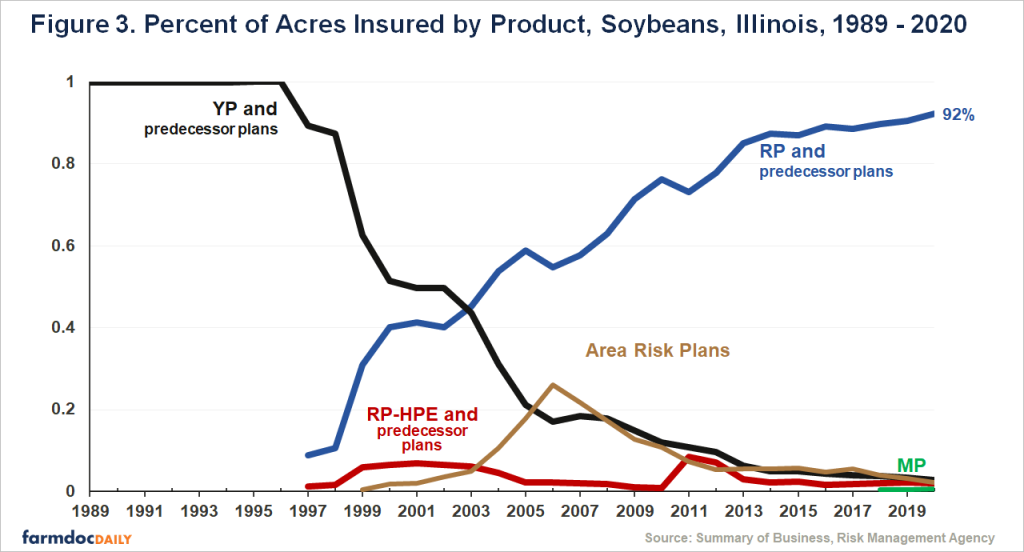

Before 1997, the only type of insurance protection available was yield insurance. In 1997, revenue products were introduced. RP predecessor plans were Crop Revenue Coverage (CRC) and Revenue Assurance (RA). RP-HPE successor plans were Income Protection (IP) and Revenue Assurance (RA). RA had an option with and without the guarantee increase.

From the mid-1990s to the present, the primary trend is the switch away from yield insurance to revenue insurances with guarantee increases (RP and predecessor products). Figure 2 shows these trends for corn in Illinois. RP and predecessor products began with 12% of insured acres in 1997. Since 2017, RP has had over 90% of insured corn acres in Illinois. Simultaneously to the RP increase has been a decline in YP and predecessor products. Yield insurances went from 100% of use in 1996 to less than 5% since 2014. In 2020, YP was used on just 2% of corn acres.

Area risk plans were introduced in 1999. Before the introduction of ARPI in 2014, area plans include Group Risk Plan (GRP), Group Risk Income Plan (GRIP), and GRIP with Harvest Revenue Option. Area risk plans increased in use from their introduction in 1999, reaching a high of 38% of acres in 2006. The implementation of higher subsidy rates for enterprise units on COMBO products in the 2008 Farm Bill has led to a decline in Area Risk Plan use. In 2020, Area Risk Plans had 2% of the acres in Illinois.

Revenue Insurance with the harvest price exclusion has never been popular. The highest use of RP-HPE occurred in 2011 and 2012 when 8% of the corn was insured with RP-HPE. In 2020, RP-HPE had 2% of insured acres.

MP was introduced in 2018. MP had 1% of insured acres in 2020.

Similar trends exist for soybeans (see Figure 3). RP has had over 90% of insured acres since 2018. In 2020, RP had a 92% share of insured acres, RP-HPE had 2%, ARP policies had 2%, and MP had 1%.

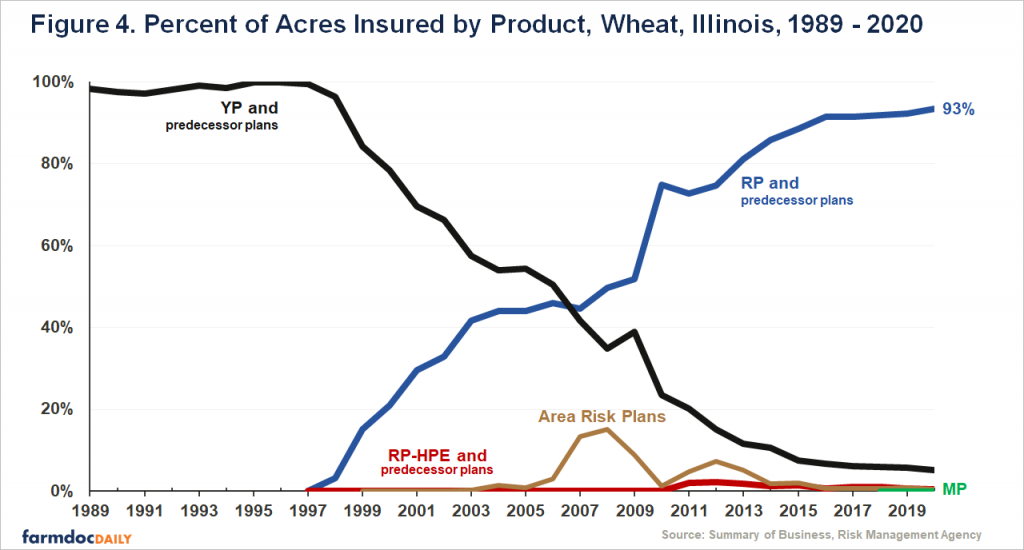

Wheat also has similar trends (see Figure 4). Since 2014, RP has had over 90% share of wheat insureds acres. In 2020, RP had 93% of wheat insured acres, YP had 5%. RP-HPE, ARP, and MP policies each had less than 1% of insured acres.

SCO has had some use in corn and wheat. In 2020, SCO was used on 12% of eligible COMBO acres for corn and 15% of eligible acres on wheat. SCO use on soybeans was 5% in 2019, declining to 2% in 2020.

Eligibility for use of SCO has been limited to acreage enrolled in the Price Loss Coverage (PLC) commodity program, with acres in the Agricultural Risk Coverage (ARC) programs ineligible (see farmdoc daily, April 30, 2020). Thus, use of SCO has likely been limited with the majority of corn and soybean base acres enrolled in ARC from 2014 to 2018. However, most corn acres were enrolled in PLC for 2019 and 2020 and, while it increased slightly, use of SCO has remained ow (see farmdoc daily, January 31, 2020 for more description on participation).

Farmers have been offered a variety of crop insurance products and have overwhelmingly settled on RP – revenue coverage with a guarantee increase. In so doing, farmers have largely rejected county-level insurance as a method of providing a base level of protection. Farmers have also rejected revenue insurance without guarantee increases. Similarly, farmers have overwhelmingly moved from yield insurances to revenue insurances.

Moving forward, one can expect farmers to continue to purchase RP. RP is likely preferred over other products for two reasons. First, it offers farm-level protection rather than county-level protection. Not having the risk of a relatively good county-yield while the farm experiences a poor yield is a risk that farmers likely to do not want to incur. Second, farmers prefer guarantee increases to those insurances without guarantee increases. The guarantee increase is useful in drought years like 2012 when harvest prices are higher than projected prices, resulting in much higher payments than products without a guarantee increase.

New crop insurances have been offered that can be used in conjunction with RP, which provide a higher band of coverage at a county-level. SCO has been available since 2015 but has had little use, possibly because of the PLC farm program requirement. Moreover, the band of coverage from 86% to the maximum RP coverage level of 85% likely has limited value. This year additional products offering county-level coverage will become available. It remains to be seen if farmers desire these products.

Coppess, J., N. Paulson, K. Swanson, G. Schnitkey and C. Zulauf. "Farm Program Update: ARC/PLC Enrollment." farmdoc daily (10):80, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 30, 2020.

Paulson, N. and J. Coppess. "Further Discussion of the Supplemental Coverage Option." farmdoc daily (4):75, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 24, 2014.

Paulson, N., J. Coppess, G. Schnitkey and C. Zulauf. "Electing ARC and Using SCO." farmdoc daily (4):241, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 17, 2014.

Schnitkey, G. "Supplemental Coverage Option: An Insurance Option Available to More Farmers." farmdoc daily (9):25, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 12, 2019.

Zulauf, C., G. Schnitkey, K. Swanson, J. Coppess and N. Paulson. "Historical Look at SCO (Supplemental Coverage Option) Participation." farmdoc daily (10):18, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 31, 2020.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.